Many individuals engaged in the fluid power supply chain rely on the insights that the Purchasing Managers Index (PMI) offers as a top leading indicator of fluid power industry activity. This measure of economic trends in manufacturing, based on a monthly survey of purchasing managers, can provide current and future insights for decision makers concerning the overall economic activity in the U.S.

The PMI is a convenient summary of the prevailing direction and scope of change in manufacturing based on five major areas: new orders, inventory levels, production, supplier deliveries and employment. A PMI index reading above 50 percent indicates that the manufacturing economy is generally expanding; a reading below 50 percent indicates that it is generally declining. The further from 50 the reading is, the greater the level of change that is taking place.

Anyone engaged in the fluid power supply chain can make sense of the relationship between their company and the PMI if they have the right resources. Learn more about what’s available for the fluid power industry below.

ISM’s PMI Resources

The PMI is prepared by the Institute for Supply Management (ISM), providing guidance to supply management professionals, economists, analysts and government and business leaders. But ISM goes beyond simply offering a reliable economic indicator data series. It also supports each monthly index addition to the data series with a full diagnostic breakdown by ISM experts via the “ISM Report on Business” every month. This report takes a very detailed look at all the factors that affect the U.S. manufacturing sector, even going beyond the five major areas mentioned above with insightful commentary and analytical charts (example below).

NFPA’s PMI Resources

Access to key leading indicator data series such as PMI index data and other economic indicators is available via NFPA’s Customer Market File (CMF) on the NFPA website as an exclusive benefit of membership. The CMF is a monthly file containing data and trend graphs for key U.S. customer markets, popular economic indicators and producer pricing that can be used for your own internal analysis needs or easily transferred into analytical tools such as NFPA’s Stats Toolkit.

NFPA’s PMI Support Tools

Take your analysis to the next level with NFPA’s Stats Toolkit to examine the strength of the relationship between your company data and PMI data. The Correlation Analysis Report, one of five custom data analysis/visualization tools in the Stats Toolkit, allows users searching for important indicators and drivers for their company to explore lead/lag and correlation analysis to recognize relationships between two data series. This report not only identifies the correlation percentage between data series for a specific date range, but also applies a monthly lead/lag effect. When shifting one data series forward (in monthly increments) to the cross-correlated data series, members can discover if the correlation percentage strengthens or weakens to possibly reveal a leading indicator for another data series.

Above is an example of the Correlation Analysis Report as we examine the 114-month relationship between Total Fluid Power shipments and PMI. The “correlation analysis with lags chart” identifies the highest correlation (93.4%) occurs when the leading series (PMI) has a 5-month lead/lag effect applied, or the leading series is shifted forward 5 months.

The Correlation Analysis Report then allows the user to generate a trend graph that applies the 5-month lead/lag effect to the leading series (PMI) for visual confirmation of the relationship between the two data series.

With a little assistance from NFPA’s market information resource benefits, anyone engaged in the fluid power supply chain can access the tools they need to confidently evaluate the relationship between their company and the PMI.

Questions? Contact Eric Armstrong, NFPA’s Economic and Statistical Programs Manager, at earmstrong@nfpa.com or (414) 778-3372.

Like this post? Share it!

Recent Posts

Upcoming Events of 2025!

Trying to plan ahead for future travel? Use this article to lock-in these events into your calendar! Attend a Fluid Power Action Challenge Event and witness hands-on fluid power education! Recruit NIU Engineering Students – Join Us for a Networking Event February 10, 2025 Rockford, IL Economic Update Event: Regional Demand Estimates Report…

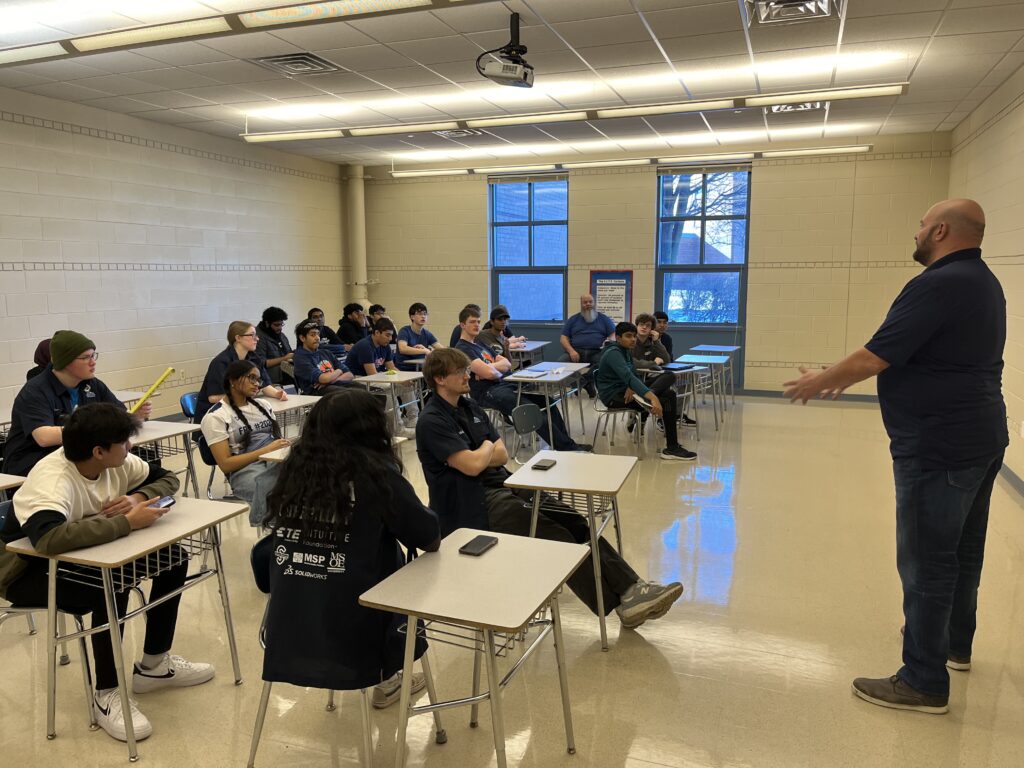

Speak with University Fluid Power Clubs this Spring

NFPA Speaker’s Bureau enables industry professionals to present to students enrolled in high schools, tech schools and universities across the country to inspire and excite them about career opportunities in the fluid power industry. We’ve heard from students and instructors that facility tours and campus visits are some of the most effective ways for students…

NFPA Welcomes New Member: GRH America

GRH America headquarter is located in Dallas, Texas, it manufactories hydraulic gear motor, gear pump, orbital motor, valves, HPU in China. GRH America sells OEM companies and works with distributors to sell its products. GRH America20181 S. Highway 78Leonard, TX 75452469-399-5700www.grhamerica.com OCR: Dick Cai, President & CEOdcai@grhamerica.com