Anyone who follows economic and market data, including NFPA’s Confidential Shipment Statistics, has seen plenty of charts the past 18 months showing dramatic swings as many data series took a plunge during the COVID shut-downs and then jumped back up this year.

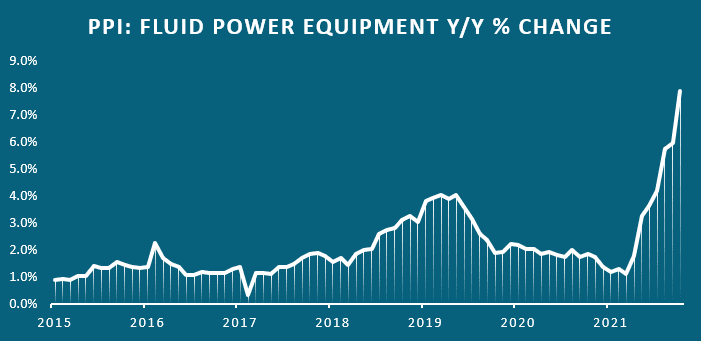

Here are a few more. Inflation has been in the news lately, with a debate raging as to whether it’s a transitory supply and demand event, or if it’s the start of a longer-lasting macroeconomic trend.

The most recent trend chart of the Producer Price Index for fluid power shows it all…a near vertical spike in the cost of fluid power equipment vs. the previous year. (You can find this and more on the PPI in the monthly Customer Market File and at the end of each month’s Confidential Shipment Statistics report).

Input Costs…Commodities, Shipping, Wages

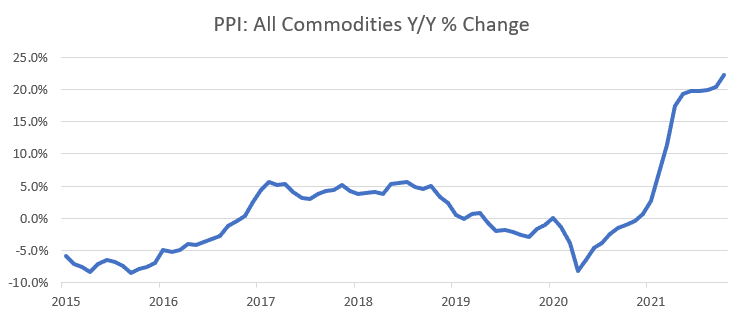

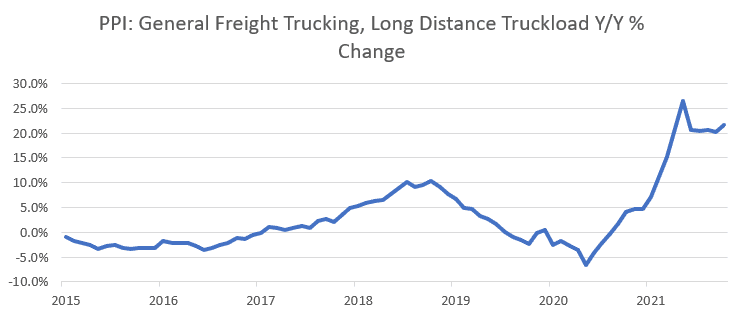

What’s driving the cost increases? Probably a lot of things.

The next two charts are based on data from the federal Bureau of Labor Statistics and show the upward surge in cost for commodities and shipping, with both up more than 20 percent on a year over year basis. These are both key inputs to fluid power costs and show a similar trajectory.

Shipping Costs

Wage inflation is another factor. NFPA’s recent Business Intelligence survey of members concerning compensation and turnover trends showed 52% of respondents raising wages more than 5% for new production/warehouse employees; and 20% raising wages for these employees more than 8%. The numbers were similar for existing production and warehouse employees. Among all employees, more than one-third reported wage/salary increases in excess of 5%.

Where is this all going? Economists Weigh-In

The National Association for Business Economics recently issued a report based on a survey of member economists. In general, their members tend to see at least some of the inflation as part of a longer trend.

- Nearly two-thirds of economists responding expect that inflation will not drop back to the Federal Reserve’s 2 percent target until the second half of 2023 or later.

- When asked to identify the main factors contributing to higher inflation in the first half of 2022, 87% cite supply chain bottlenecks, 76% indicate strong consumer demand and 69% note rising wages.

- Longer term, over the next three years, economists suggest the drivers of inflation are less supply chain driven and more focused on rising wages and strong consumer demand.

- When asked about the relatively low labor force participation rate we’re currently experiencing, 50% do not expect it to return to pre-pandemic levels, and 46% cite increased rates of retirement as the reason for low levels of labor force participation.

Like this post? Share it!

Recent Posts

Fall 2024 Fluid Power Recruitment Event with NIU

RSVP for our Fall 2024 Fluid Power Recruitment Event with Northern Illinois University (NIU). NIU is one of seven universities recognized as a Power Partner, teaching fluid power competencies and engaging in all NFPA educational programs. At this event, your company will have the opportunity to connect directly with NIU engineering students. Engaging in meaningful conversations,…

Now Announcing: Cuyahoga Community College as a Fast Track Hub in Ohio

NFPA’s Fast Track to Fluid Power is a workforce development pathway that partners local technical colleges with fluid power industry members and high school teachers. These networks create awareness and interest in fluid power and train students along a path that leads to careers in fluid power at NFPA member companies. We are pleased to…

Now Announcing: Houston Community College as a Fast Track Hub in Texas

NFPA’s Fast Track to Fluid Power is a workforce development pathway that partners local technical colleges with fluid power industry members and high school teachers. These networks create awareness and interest in fluid power and train students along a path that leads to careers in fluid power at NFPA member companies. We are pleased to…