Anyone who follows economic and market data, including NFPA’s Confidential Shipment Statistics, has seen plenty of charts the past 18 months showing dramatic swings as many data series took a plunge during the COVID shut-downs and then jumped back up this year.

Here are a few more. Inflation has been in the news lately, with a debate raging as to whether it’s a transitory supply and demand event, or if it’s the start of a longer-lasting macroeconomic trend.

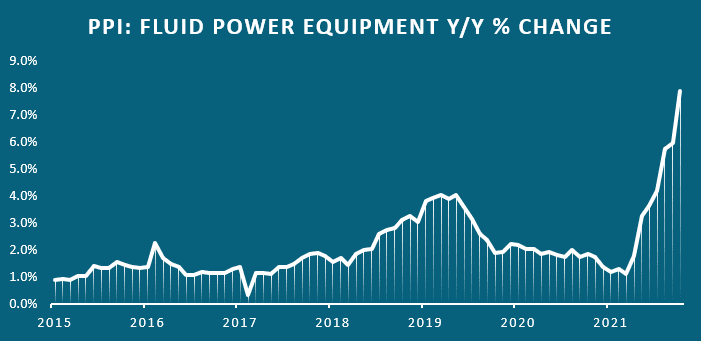

The most recent trend chart of the Producer Price Index for fluid power shows it all…a near vertical spike in the cost of fluid power equipment vs. the previous year. (You can find this and more on the PPI in the monthly Customer Market File and at the end of each month’s Confidential Shipment Statistics report).

Input Costs…Commodities, Shipping, Wages

What’s driving the cost increases? Probably a lot of things.

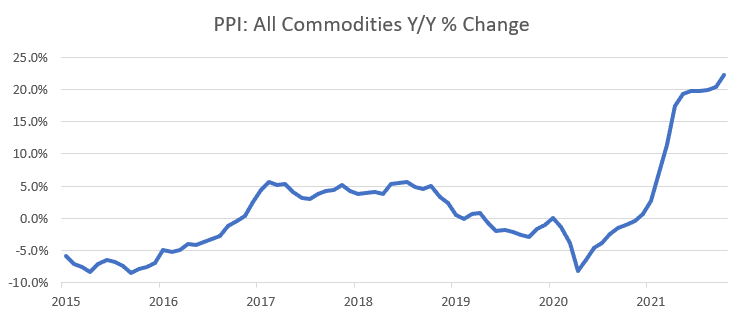

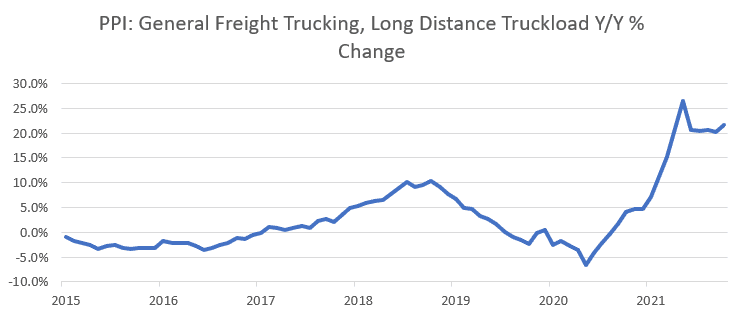

The next two charts are based on data from the federal Bureau of Labor Statistics and show the upward surge in cost for commodities and shipping, with both up more than 20 percent on a year over year basis. These are both key inputs to fluid power costs and show a similar trajectory.

Shipping Costs

Wage inflation is another factor. NFPA’s recent Business Intelligence survey of members concerning compensation and turnover trends showed 52% of respondents raising wages more than 5% for new production/warehouse employees; and 20% raising wages for these employees more than 8%. The numbers were similar for existing production and warehouse employees. Among all employees, more than one-third reported wage/salary increases in excess of 5%.

Where is this all going? Economists Weigh-In

The National Association for Business Economics recently issued a report based on a survey of member economists. In general, their members tend to see at least some of the inflation as part of a longer trend.

- Nearly two-thirds of economists responding expect that inflation will not drop back to the Federal Reserve’s 2 percent target until the second half of 2023 or later.

- When asked to identify the main factors contributing to higher inflation in the first half of 2022, 87% cite supply chain bottlenecks, 76% indicate strong consumer demand and 69% note rising wages.

- Longer term, over the next three years, economists suggest the drivers of inflation are less supply chain driven and more focused on rising wages and strong consumer demand.

- When asked about the relatively low labor force participation rate we’re currently experiencing, 50% do not expect it to return to pre-pandemic levels, and 46% cite increased rates of retirement as the reason for low levels of labor force participation.

Like this post? Share it!

Recent Posts

Member Highlights the Value of NFPA’s Conferences

At NFPA, our members’ experiences are the foundation of what we do. We’re excited to share our latest testimonial video featuring Ken Baker, CEO of Bailey International, who underscores the value of attending NFPA events. In his video, Ken highlights how the Economic & Industry Outlook Conference provides invaluable insights for his business. From the…

NAM Regulatory Update: House Passes Critical Minerals Bill

As part of an effort to bring more information about the regulatory and legal environment facing American manufacturers, NFPA is monitoring the newsfeed of the National Association of Manufacturers (NAM) and will be bringing important updates like this to the attention of NFPA members. (November 15, 2024) The House easily passed an NAM-backed bill intended…

Fall 2024 Economic Update Webinar – Recording Available

The most recent NFPA Economic Update Webinar featured Lauren Saidel-Baker of ITR Economics. Learn what to expect from a number of our industry’s most popular customer markets, while also getting the answers you need to the short-term outlook for the fluid power industry. These insights and more are available to NFPA members in the archived recording of the…