Global Fluid Power Report and Forecast

- Includes a global macro summary, by-country customer market forecast & analysis, as well as by-country fluid power industry forecasts.

- Countries covered in the report: US, Canada, Mexico, Brazil Poland, Netherlands, Italy, Germany, France, Belgium, UK, Russia, Taiwan, South Korea, Japan, Indonesia, India, China, Australia, UAE, and South Africa.

Insights include:

- On a global scale, hydraulic-consuming sectors are expected to fall to 0.3% in 2024 whereas pneumatics-sectors are forecasted to hit a 3.4% annual growth rate.

- Agricultural machinery has the worst growth prospects as an end-of-use sector while electronic components and boards and other general-purpose machinery are expected to grow the fastest this year.

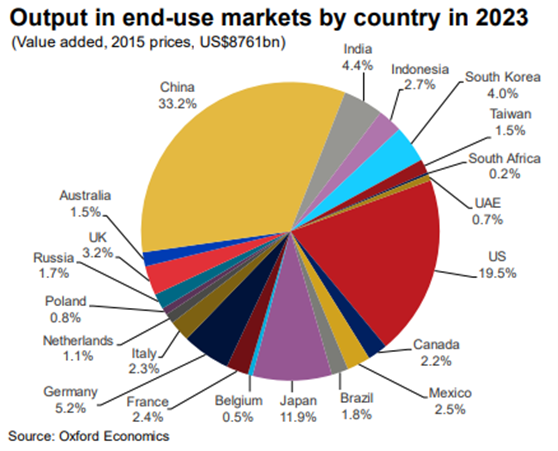

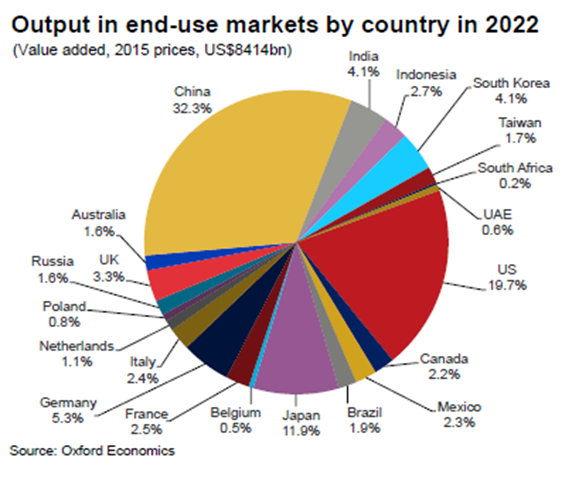

- In the following pie charts, output in end-use markets from 2022 to 2023 saw increases for China, India, US, Mexico, and the UAE. Europe’s output suffered as Germany, France, Italy, Russia, and the U.K. all shrank slightly.

By Country Briefings and Forecasts

- These are quarterly country specific reports that examine 68 individual countries and include the following:

- Global macro summary

- Detailed data and analysis of customer markets

- Customer market forecasts

- Highlights the fastest and slowest growing sectors.

Insights include:

- US’s industrial production growth is expected to gradually slow to 1.4% in 2024 from its previous value of 1.8% in 2023.

- Germany’s industrial output is forecasted to contract again in 2024 by 0.5%. Oxford considers these contractions to be largely cyclically driven with the next projected period of robust growth to be around mid-2025 at the earliest.

- Brazil’s extraction output is expected to rise 5.2% in 2024 but slowdown in 2025 to 2.6%.

To access these reports, click HERE, and go to either “Global Fluid Power Report and Forecast” or “By-Country Industry Briefings and Forecasts”.

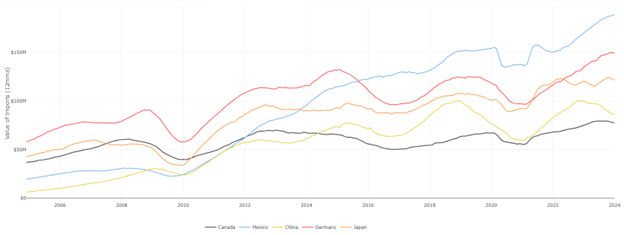

NFPA tracks foreign trade data broken down by country and product and provides interactive summary tables for a quick look at the last 12 months. Use this data to find the leading destinations and sources of fluid power products. Below is an example of the Leading Sources of Fluid Power Imports summary page available on the report. The data series below is plotted with a 12-month moving average (12mma) and depicts the top 5 leading importers of fluid power to the United States.

- As shown in the graph, Germany continued to overall increase exports to the United States throughout 2023 but appears to be reaching a plateau.

- China’s exports to the United States have slowed down throughout 2023. Oxford in their Global Fluid Power Report note that China’s capacity for production will be tested by the willingness of other economies to accommodate increased Chinese exports as external demand rises in 2024.

- Mexico’s increasing trendline could hint at success in the nearshoring movement over the years.

All data in this article can be found in NFPA’s Foreign Trade for Fluid Power Products report with a member login.

Do you have questions, or need an NFPA member hub login? Contact Cecilia Bart at cbart@nfpa.com or 414-259-2027.

Like this post? Share it!

Recent Posts

Fall 2024 Fluid Power Recruitment Event with NIU

RSVP for our Fall 2024 Fluid Power Recruitment Event with Northern Illinois University (NIU). NIU is one of seven universities recognized as a Power Partner, teaching fluid power competencies and engaging in all NFPA educational programs. At this event, your company will have the opportunity to connect directly with NIU engineering students. Engaging in meaningful conversations,…

Now Announcing: Cuyahoga Community College as a Fast Track Hub in Ohio

NFPA’s Fast Track to Fluid Power is a workforce development pathway that partners local technical colleges with fluid power industry members and high school teachers. These networks create awareness and interest in fluid power and train students along a path that leads to careers in fluid power at NFPA member companies. We are pleased to…

Now Announcing: Houston Community College as a Fast Track Hub in Texas

NFPA’s Fast Track to Fluid Power is a workforce development pathway that partners local technical colleges with fluid power industry members and high school teachers. These networks create awareness and interest in fluid power and train students along a path that leads to careers in fluid power at NFPA member companies. We are pleased to…