Global Fluid Power Report and Forecast includes a global macro summary, by-country customer market forecast & analysis, as well as by-country fluid power industry forecasts. Countries covered in the report: US, Canada, Mexico, Brazil Poland, Netherlands, Italy, Germany, France, Belgium, UK, Russia, Taiwan, South Korea, Japan, Indonesia, India, China, Australia, UAE, and South Africa.

Oxford Economics released the following summary of updates with the latest forecast release:

- We have maintained our forecast for global GDP growth at approximately 2.7% in 2024 and revised our 2025 projection upwards to 2.8%.

- A second Trump term, with full Republican control of Congress, is expected to boost the global economy in the short term through increased fiscal stimulus, primarily via lower taxes. However, risks remain skewed to the downside. While policies may support investment spending, they could also drive higher prices and slow the pace of interest rate easing.

- Over the medium term, potential blanket tariffs on China, targeted tariffs on other trading partners, and reduced immigration may constrain labour supply, increase wage pressures, and dampen growth.

- Outside the US, we expect a decline in investment activity due to heightened uncertainty and elevated borrowing costs.

- We have revised our 2025 industrial production forecast marginally to approximately 3.1%, as downgrades in Europe offset near-term upgrades in the US and China.

- Capital goods sectors like electronics, transportation equipment, and construction will benefit from stronger business investment driven by lower corporate taxes and earlier productivity gains in the US, while in China, fiscal and monetary stimulus will boost production, supported by frontloaded orders ahead of anticipated tariffs.

- In Europe, the industrial recession is nearing its end, with declining energy prices easing the downturn, though recovery is unlikely until late 2025, with a full rebound expected by 2026 as interest rate cuts take effect, coinciding with US tariffs on steel, aluminum, and motor vehicles.

- In the US, fiscal expansion will support demand across most sectors, but potential inflationary pressures may slow the monetary easing cycle, while reduced immigration will disproportionately affect labor-intensive industries like construction.

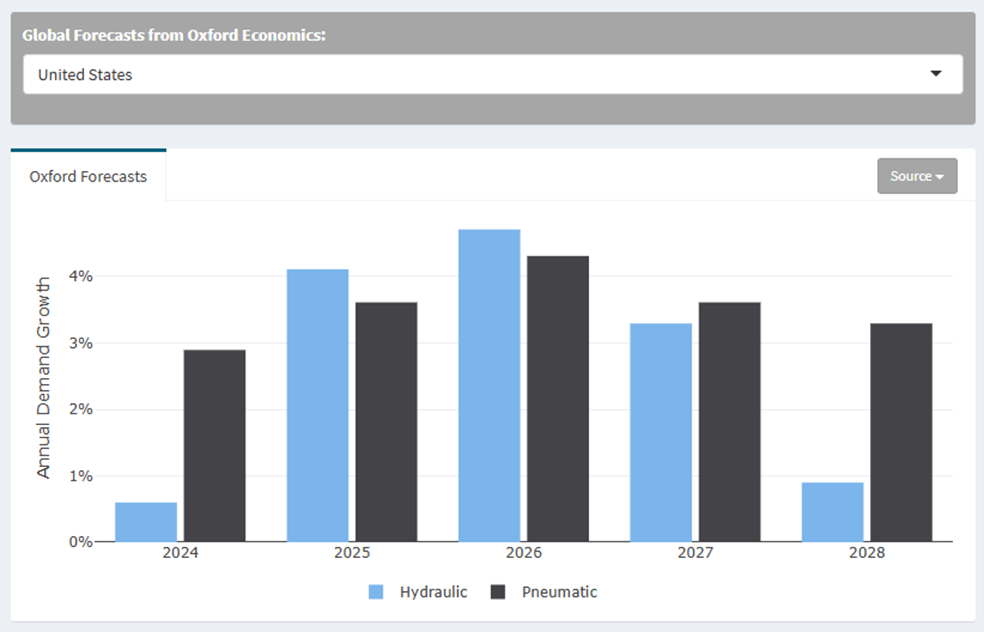

The snapshot below from the NFPA Stats Dashboard provides a quick look at Oxford’s Fluid Power growth forecast for the United States and a few other countries.

Interested in downloading the complete forecast dataset? Visit the NFPA Stats Toolkit at this link https://nfpahub.com/stats/toolkit/ to quickly retrieve the forecast files for the entire Oxford Fluid Power Forecast report.

Questions? Contact Cecilia Bart at cbart@nfpa.com or 414-259-2027.

Like this post? Share it!

Recent Posts

Explore Speaker Lineup for NFPA’s 2025 Annual Conference

2025 NFPA Annual ConferenceFebruary 25-27, 2025Tucson, AZRegistration Now Open NFPA’s upcoming 2025 Annual Conference will feature a lineup of expert speakers dedicated to sharing valuable insights and information with attendees. Ranging in topics from geopolitical disruption to the future of fluid power updates, attendees can expect the presentations to provide exclusive content that can’t be found anywhere…

Please Complete and Share Survey on Drivers in Fluid Power Customer Markets

The National Fluid Power Association (NFPA) seeks to engage with stakeholders across the fluid power supply chain to publish a technology roadmap for fluid power in industrial, or in-plant, applications. This roadmap will be a document that describes the evolving needs of companies in fluid power’s many industrial customer markets, the degree to which fluid…