Oxford’s Monthly Industry Briefings for July have been released and are available on the website. These reports contain the latest developments for eleven major industries around the globe with short industry briefs provided by Oxford Economics. These two-to-three-page briefs include a short-written summary, output/trend graphs, and an output table.

NFPA’s Econ and Market Indicators (EMI) report has been updated for July. The EMI report pulls together data from multiple sources to provide the latest trends for:

- Customer Markets (U.S. Census Bureau)

- Economic Indicators (U.S. Census Bureau)

- Industrial Production (Federal Reserve)

- Capacity Utilization (Federal Reserve)

- Producer Price Index (Bureau of Labor Statistics)

Highlights between the three on a few industries focusing on the United States include the following:

- Overall

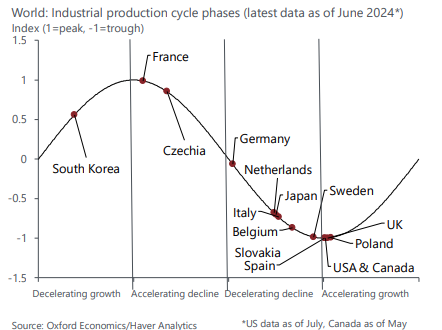

- US industrial production fell by 0.6% in July according to Oxford’s latest report, as recent weather spikes are normalizing as we move into autumn. In the image below, Oxford suspects US industrial production phase is reaching a trough in the business cycle.

- Construction

- Oxford reports that US housing starts slowed in July to 6.8% m/m. Year to date housing starts compared to last year are down 4.7% in July.

- As shown in the EMI report, construction manufacturing shipments dropped -13.0% m/m in July and hovered at 0.5% y/y.

- Motor Vehicles

- Oxford’s latest briefing reports that motor vehicles production dropped 12% in July, but they suggest that the rapid change was due to auto manufacturers performing maintenance and preparing factories for new models.

- The EMI report reveals that motor vehicles and parts shipments fell -16.1% m/m in July. Automobile, light truck, and utility vehicle industrial production similarly fell in July to -25.8% m/m.

- Chemical and Pharmaceutical

- The US chemicals and pharmaceutical sector expanded for a third consecutive month in July according to Oxford’s latest briefing.

- As shown in the EMI report, chemical products manufacturing shipments are down to -2.2% in July m/m, however, they’re up 9.1% y/y. Chemical products as well as pharmaceutical and medicine products have been trending positively over the last few months.

Oxford Monthly Industry Briefings can be accessed at this link: https://nfpahub.com/stats/reports-data/global-market-reports-forecasts/industry-briefings/

The EMI report can be accessed at this link: https://nfpahub.com/reports/econ-market-indicator/. An excel file with all the raw data is also available to download for internal analysis. Members can view individual series and apply different calculations such as moving averages and rates of change.

Questions? Contact Cecilia Bart at cbart@nfpa.com or 414-259-2027.

Like this post? Share it!

Recent Posts

Explore Speaker Lineup for NFPA’s 2025 Annual Conference

2025 NFPA Annual ConferenceFebruary 25-27, 2025Tucson, AZRegistration Now Open NFPA’s upcoming 2025 Annual Conference will feature a lineup of expert speakers dedicated to sharing valuable insights and information with attendees. Ranging in topics from geopolitical disruption to the future of fluid power updates, attendees can expect the presentations to provide exclusive content that can’t be found anywhere…

Please Complete and Share Survey on Drivers in Fluid Power Customer Markets

The National Fluid Power Association (NFPA) seeks to engage with stakeholders across the fluid power supply chain to publish a technology roadmap for fluid power in industrial, or in-plant, applications. This roadmap will be a document that describes the evolving needs of companies in fluid power’s many industrial customer markets, the degree to which fluid…

Oxford Economics Winter Fluid Power Forecast Out Now!

Global Fluid Power Report and Forecast includes a global macro summary, by-country customer market forecast & analysis, as well as by-country fluid power industry forecasts. Countries covered in the report: US, Canada, Mexico, Brazil Poland, Netherlands, Italy, Germany, France, Belgium, UK, Russia, Taiwan, South Korea, Japan, Indonesia, India, China, Australia, UAE, and South Africa. Oxford Economics released the…