Every other year, the National Fluid Power Association (NFPA) engages with stakeholders across the fluid power supply chain to refresh and re-publish its Technology Roadmap for the Fluid Power Industry. The NFPA Roadmap is a document that describes the evolving needs of companies in fluid power’s many customer markets, the degree to which fluid power is capable of meeting those needs, and the R&D objectives that will help fluid power meet or better meet those needs in the future. We have now begun a new refresh cycle that will culminate in the production of a new document in August 2023.

The process is overseen by the NFPA Roadmap Committee – which for this cycle is chaired by Bradlee Dittmer of NORGREN and vice-chaired by Steve Meislahn of Sun Hydraulics/Helios. The committee met on January 12, 2023 to review the results of a recently-conducted survey on technology drivers in fluid power customer markets and to determine the customer drivers and strategies that will help frame the remaining elements of our 2023 roadmap update.

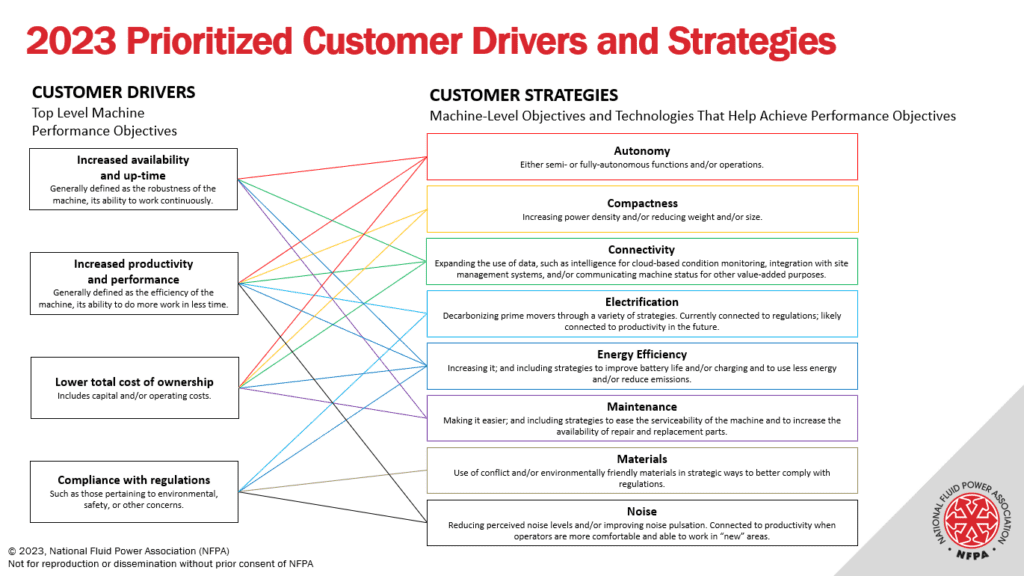

A Customer Driver is a top level performance objective that machine builders in the markets served by fluid power have for their machines. A Customer Strategy is a machine-level objective or technology that is currently being deployed to help those machine builders achieve their performance objectives. A graphic listing the key drivers and strategies – and how they are connected to each other – is attached.

In summary, four Customer Drivers were identified:

- Increased availability and up-time. Generally defined as the robustness of the machine, its ability to work continuously.

- Increased productivity and performance. Generally defined as the efficiency of the machine, its ability to do more work in less time.

- Lower total cost of ownership. Includes capital and/or operating costs.

- Compliance with regulations. Such as those pertaining to environmental, safety, or other concerns.

As well as eight Customer Strategies:

- Autonomy. Either semi- or fully-autonomous functions and/or operations.

- Compactness. Increasing power density and/or reducing weight and/or size.

- Connectivity. Expanding the use of data, such as intelligence for cloud-based condition monitoring, integration with site management systems, and/or communicating machine status for other value-added purposes.

- Electrification. Decarbonizing prime movers through a variety of strategies.

- Energy Efficiency. Increasing it; and including strategies to improve battery life and/or charging and to use less energy and/or reduce emissions.

- Maintenance. Making it easier; and including strategies to ease the serviceability of the machine and to increase the availability of repair and replacement parts.

- Materials. Use of conflict and/or environmentally friendly materials in strategic ways to better comply with regulations.

- Noise. Reducing perceived noise levels and/or improving noise pulsation.

Special thanks goes to the many partner associations, including some representing key customer markets, whose members participated in the survey and in committee discussion. These associations include the Association for High Technology Distribution (AHTD), the Power Transmission Distributors Association (PTDA), the Packaging Machinery Manufacturers Institute (PMMI), the Association of Equipment Manufacturers (AEM), and the Association for Manufacturing Technology (AMT).

A copy of the Committee’s full report can be downloaded from the Committee’s project website at https://www.nfpa.com/home/membership/NFPA-Technology-Roadmap.htm.

Eric Lanke, NFPA President/CEO, is available to present the report and its findings to your group or company. Contact him at elanke@nfpa.com if you have interest.

The Committee will now move onto the next step in the roadmapping process – determining the fluid power capability improvements, the ways in which fluid power systems must improve if they are to meet or better meet the customer needs described by these drivers and strategies. To that end, we have launched two new surveys to collect feedback from the widest possible group of stakeholders across the fluid power supply chain. One survey is focused on hydraulic improvements, the second on pneumatic improvements:

Hydraulic survey = https://www.surveymonkey.com/r/5XBY2FV

Pneumatic survey = https://www.surveymonkey.com/r/53H38H2

Based on your area of interest and expertise, you can complete one survey, the other, or both. They will remain open until February 16, 2023.

The Committee next meets on March 2, 2023. Stakeholders with interest in joining the committee and/or participating in the roadmapping process should contact Eric Lanke at elanke@nfpa.com.

Like this post? Share it!

Recent Posts

Update to Regional Demand Estimates Report Now Available

The U.S. Fluid Power Regional Demand Estimates Report has been updated with 2023 estimates and is now available for download. This Excel-based report is prepared for NFPA by Oxford Economics and profiles the geographic distribution of fluid power products to end-use industries by state, including fluid power sales dollars, fluid power sales percentage, and number of…

Hear from an NCAT Student Engaged in NFPA Workforce Programs

We’re excited to share a new testimonial video from David Castro Lastor, a junior mechanical engineering student at North Carolina Agricultural and Technical State University and president of the university’s Fluid Power Club. In his video, David shares how participating in NFPA programs has shaped his academic and personal growth. Through his leadership in the…

New Episode of Fluid Power Forum: Advanced Modeling Techniques and Performance Comparisons of Electrohydraulic Systems

Today, our guest is Bruno Dupuis. Bruno is a Corporate Accounts Manager at Famic Technologies Inc., the company behind the development of Automation Studio™, a circuit design and simulation software for fluid power, electrical, robotics, process control and automation projects. He presented at NFPA’s Hydraulics Conference co-located at the 2024 iVT EXPO back in August.…