NFPA’s Econ and Market Indicators (EMI) report has been updated for April. The EMI report pulls together data from multiple sources to provide the latest trends for:

- Customer Markets (U.S. Census Bureau)

- Economic Indicators (U.S. Census Bureau)

- Industrial Production (Federal Reserve)

- Capacity Utilization (Federal Reserve)

- Producer Price Index (Bureau of Labor Statistics)

Highlights from the updated report include the following:

- Construction

- As shown in the EMI report, total construction spending: manufacturing in the United States’ 3/12 and 12/12 rates of change have decreased since December 2023, settling down after a period of rapid growth. Additionally, Construction Manufacturing equipment shipments have been slowing down throughout 2023 and 2024, with the latest m/m increase being 0.6% this May.

- In ITR’s most recent report, forecasts US Construction Machinery Production to end the year at -13.1% for 2024. They also state that the sector is currently in a recessionary phase, as of April 2024.

- Pharmaceutical

- The updated EMI report shows that pharmaceutical and medicine manufacturing shipments continue to trend upward with May shipments being up 4% m/m and 9.2% y/y. Chemical product manufacturing shipments are also trending positively but at a much shallower rate with a 2.2% m/m increase.

- Farm Machinery and Equipment

- The EMI report shows farm machinery and equipment industrial production has been trending downwards on a 12-month average. In May, the sector’s industrial production index decreased -4.1% y/y and a 12/12 rate of change at -6.7%.

- In Oxford’s by country report on the United States, Oxford forecasts agricultural machinery to have an annual percent change of -0.6% at the end of 2024 and 3.3% in 2025.

- Petroleum Refineries

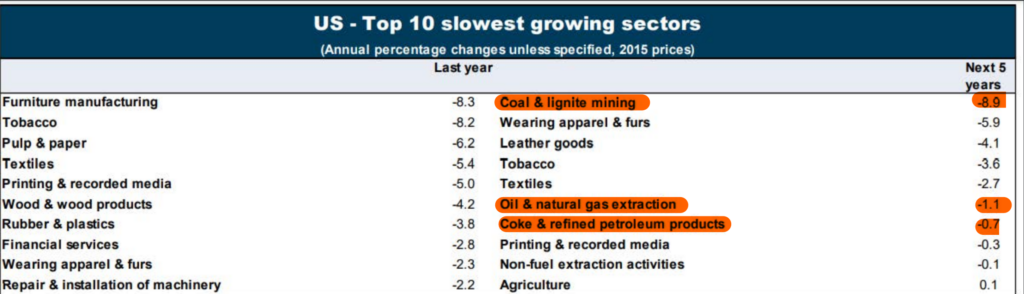

- Petroleum Refinery shipments, according to the EMI report, are down -4.0 m/m in May but up 4.5% y/y. The industrial production index for petroleum refineries are up 4.5% m/m in May and increased 2.3% y/y as well. When looking at the petroleum refinery’s industrial production index using the 12mma calculation, the sector has been experiencing shallow growth over the last year. Oxford includes several sectors of the mining industry in their forecasted top 10 slowest growing sectors in the US.

The EMI report can be accessed at this link: https://nfpahub.com/reports/econ-market-indicator/. An excel file with all the raw data is also available to download for internal analysis. Members can view individual series and apply different calculations such as moving averages and rates of change.

The ITR forecast referenced in this article can be found at this link: https://nfpahub.com/reports/nfpa-forecast-report-u-s-customer-markets/

The Oxford report referenced in this article can be found at this link: https://nfpahub.com/wp-content/uploads/2024/06/usIISDB190624.pdf

Questions? Contact Cecilia Bart at cbart@nfpa.com or 414-259-2027.

Like this post? Share it!

Recent Posts

Explore Speaker Lineup for NFPA’s 2025 Annual Conference

2025 NFPA Annual ConferenceFebruary 25-27, 2025Tucson, AZRegistration Now Open NFPA’s upcoming 2025 Annual Conference will feature a lineup of expert speakers dedicated to sharing valuable insights and information with attendees. Ranging in topics from geopolitical disruption to the future of fluid power updates, attendees can expect the presentations to provide exclusive content that can’t be found anywhere…

Please Complete and Share Survey on Drivers in Fluid Power Customer Markets

The National Fluid Power Association (NFPA) seeks to engage with stakeholders across the fluid power supply chain to publish a technology roadmap for fluid power in industrial, or in-plant, applications. This roadmap will be a document that describes the evolving needs of companies in fluid power’s many industrial customer markets, the degree to which fluid…

Oxford Economics Winter Fluid Power Forecast Out Now!

Global Fluid Power Report and Forecast includes a global macro summary, by-country customer market forecast & analysis, as well as by-country fluid power industry forecasts. Countries covered in the report: US, Canada, Mexico, Brazil Poland, Netherlands, Italy, Germany, France, Belgium, UK, Russia, Taiwan, South Korea, Japan, Indonesia, India, China, Australia, UAE, and South Africa. Oxford Economics released the…