NFPA’s May 2020 Confidential Shipment Statistics (CSS) report, a monthly source of fluid power shipment and order data trends often used to benchmark company performance, continues to expose COVID-19’s impact on the fluid power industry with severe declines in year-to-year and year-to-date fluid power shipment and order trends. May shipments were down again, and orders are down even more with recessionary declines in industry shipments of 30% compared to last year and greater declines of 30% to 50% in industry orders compared to last year. The continued decline in orders for May suggests June will continue to be rough for industry shipments.

Pneumatics orders have been less affected through May, but anecdotal indications and component-level CSS data suggest pneumatics has been helped by medical equipment/ventilator demand. However, companies should be watchful of the outlook for that demand going forward.

Time will tell how long these massive declines continue as the country tries to re-open and re-stimulate the economy. Fluid power industry order data at both a market and product level suggest a continued decline at this time.

Preliminary May 2020 shipments of fluid power products decreased 31.4% compared to May 2019 and decreased 2.8% when compared to April 2020. Mobile hydraulic, industrial hydraulic and pneumatic shipments decreased when compared to last year. Mobile hydraulic and industrial hydraulic shipments decreased, while pneumatic shipments increased when compared to last month.

Final April 2020 shipments of fluid power products decreased 14.2% for the 2020 calendar year when compared to the same time period in 2019. The 12-Month Moving Average (MMA) index of 89.3, an indicator of change in the size of the industry, continues to drop below 100, while the 12/12 Ratio index of 89.0, an indicator of change in the rate of growth in the industry, is below 100 as well. The direction and speed in which these two index indicators move, as well as their position above or below 100, can help demonstrate the short-term outlook for our industry.

Keep a close eye on the “percent change from last month” trends in the CSS report as this may very well be our industry’s true indicator of recovery. Large increases in the double-digit range could be the sign that a recovery is taking hold and much more positive rates-of-change are on the horizon.

[panel style=”box”]

The Confidential Shipment Statistics (CSS) Program

The CSS report is the only monthly source of aggregated industry data for the U.S. fluid power industry. This report presents data on monthly shipments and orders collected from our membership and helps users understand trends and anticipate change within the industry. Member companies can benchmark their own company’s performance against overall industry performance using the CSS results. Data is collected from participating U.S. fluid power manufacturers, compiled by a 3rd party to maintain confidentiality and results are then only sent to CSS participants. Enroll in CSS online

[/panel]

Questions and inquiries about participating in the Confidential Shipment Statistics (CSS) program can be directed to Eric Armstrong at earmstrong@nfpa.com or (414) 778-3372.

Like this post? Share it!

Recent Posts

Upcoming Events of 2025!

Trying to plan ahead for future travel? Use this article to lock-in these events into your calendar! Attend a Fluid Power Action Challenge Event and witness hands-on fluid power education! Recruit NIU Engineering Students – Join Us for a Networking Event February 10, 2025 Rockford, IL Economic Update Event: Regional Demand Estimates Report…

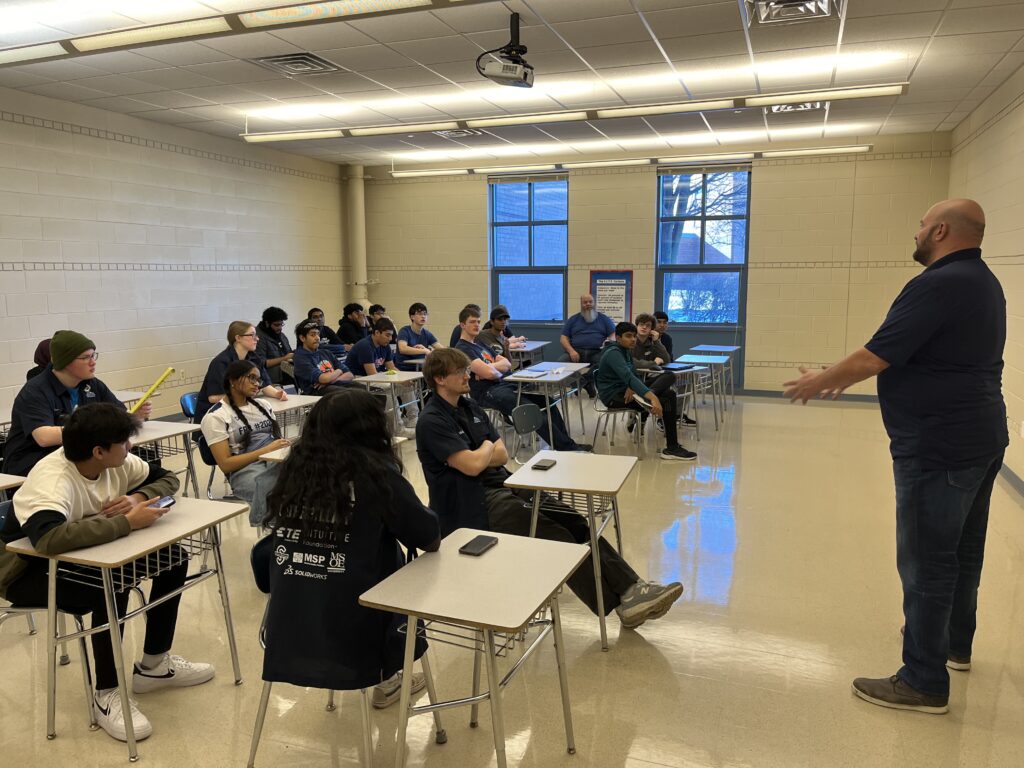

Speak with University Fluid Power Clubs this Spring

NFPA Speaker’s Bureau enables industry professionals to present to students enrolled in high schools, tech schools and universities across the country to inspire and excite them about career opportunities in the fluid power industry. We’ve heard from students and instructors that facility tours and campus visits are some of the most effective ways for students…

NFPA Welcomes New Member: GRH America

GRH America headquarter is located in Dallas, Texas, it manufactories hydraulic gear motor, gear pump, orbital motor, valves, HPU in China. GRH America sells OEM companies and works with distributors to sell its products. GRH America20181 S. Highway 78Leonard, TX 75452469-399-5700www.grhamerica.com OCR: Dick Cai, President & CEOdcai@grhamerica.com